Reading time: 10 min

Jiffy, established in 2021, was initially launched as a delivery startup in London. Operating as a qCommerce venture, we achieved remarkable efficiency, enabling us to fulfil deliveries across London in just 15 minutes, outperforming our competitors with an OPS efficiency 3–4 times greater.

This accomplishment was the result of the combined 10-15+ years of ecommerce experience possessed by each of Jiffy's founders. We meticulously integrated all our online selling expertise into our software solution, encompassing automated ordering and intelligent algorithm-driven automatic replenishment, real-time reporting, and turnover enhancement. Presently, our company is dedicated to assisting businesses in swiftly transitioning to ecommerce or enhancing their existing processes. We leverage our expertise and innovative platform to increase their profit margins.

However, on the way to financial success, our business faced a number of challenges, and we are now willing to share a few cases that Jiffy managed to overcome:

We initiated our journey with a fundamental question: how to increase profit margin? In pursuit of the correct solution, we opted to embark on a series of experiments and implement minor improvements aimed to increase our margins.

One of these fast experiments allowed us to pull up our gross margin by a good 1.5 p.p. through changing our product sorting algorithm from conversion to margin optimization. Thus, more relevant expensive products and products with higher margin began to appear in the top of the catalogue, which made the margin per order grow from 25.6% to 27.1%.

As we are a data-driven company, we’ve measured the impact of this profit margin improvement via A/B test, and it appeared to be statistically significant. This rise became possible due to tracking catalogue page and search results page for each SKU in the app on the personalised level. We also started tracking sales, orders, and items sold, which, together with monitoring purchase prices and customer prices, helped the company create a new sorting algorithm and use it in the application.

We conducted more than 50 of such tests. Each of them took weeks or even days, resulting in a total gross profit margin improvement of a good 122% over 4 months.

Our team regularly reviewed the performance of each particular product on a monthly basis and were able to exclude low-performing products (25%) from our assortment and also to speed up turnover, which helped us increase our profit margin.

We also were able to lower working capital required to test product performance through optimization of the product testing framework. To implement the framework, we performed a variation of ABC analysis of our inventory. They included not only categorising the products based on their sales stats – we also considered the number of views per item. As a result, it helped us understand whether a product's bad performance was due to its unpopularity, or to its poor ranking and lack of exposure on the app.

This framework allowed us to test products on a small/limited number of retail stores and decide whether rollout to the whole network was reasonable.

This might be a tricky part for many ecommerce retailers, but our system supported working with analytics both from the sales perspective and ecommerce application events, such as views per item, which allowed us to increase our profit margins.

After implementing our riders planning system, we increased the riders’ throughput (orders per rider per hour) by a good 21% (from 1.61 to 1.99) in two-weeks time. The throughput went up even though we used to lack riders in the evenings and faced the excess of them in the mornings.

The idea behind the system is that the demand volume is highly seasonal by hour, day and each particular retail store. So, we came up with a decision to forecast the demand by store, hour, and day for the next 7 days using forecasting tools from the data warehouse. As a result, we could thoroughly calculate the riders' shifts in accordance with the demand forecast.

More to that, we’ve fully automated order assignment and batching via our courier management software, making it possible to decrease delivery contribution to cost-per-order (CPO). In our case, we were able to save 1 FTE per retail store for order dispatching, which really helped increase our profit margins.

It is obvious that promo codes and vouchers are the market standard for customer acquisition in quick commerce now. Nevertheless, it is widely understood that aggressive promo codes attract mainly one-time customers, but we want to have a higher lifetime value (LTV) and loyal customer base.

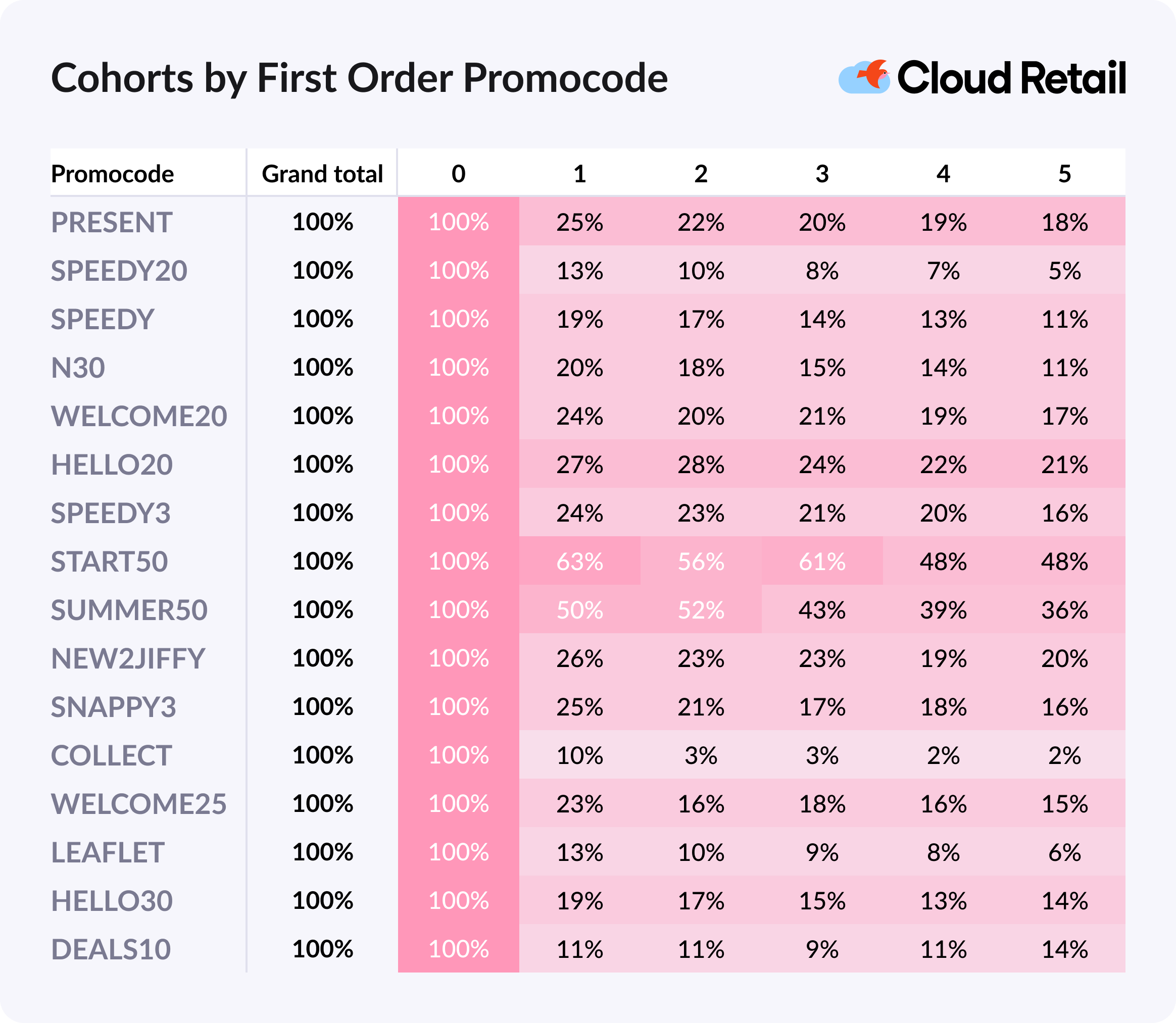

A cohort analysis of the customers by first order promo code showed which of them have higher LTV:

After compiling this report, we’ve started to implement different promocode mechanics and test different combinations of settings – promo codes with fixed amount, discounts as a percent of the customers’ basket, promo codes for several first orders, etc.

At the end, poor performing promo codes had been cancelled, and we improved the average lifetime value of the customers by a good 12%, which influenced the increase in the profit margins.

Building a healthy business requires a healthy target average order value (AOV). One of the methods of raising AOV is to incentivize customers to buy more items in one order.

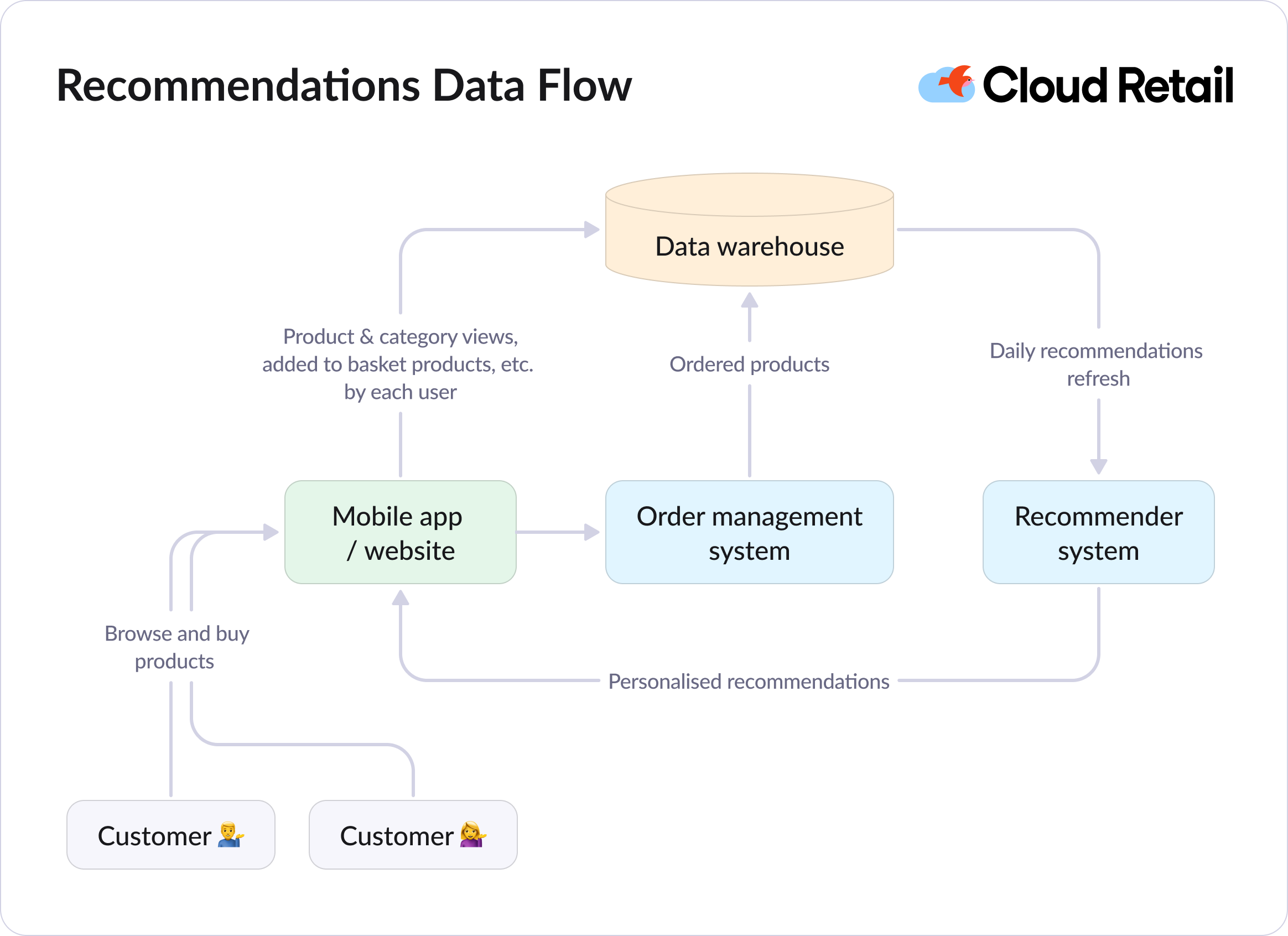

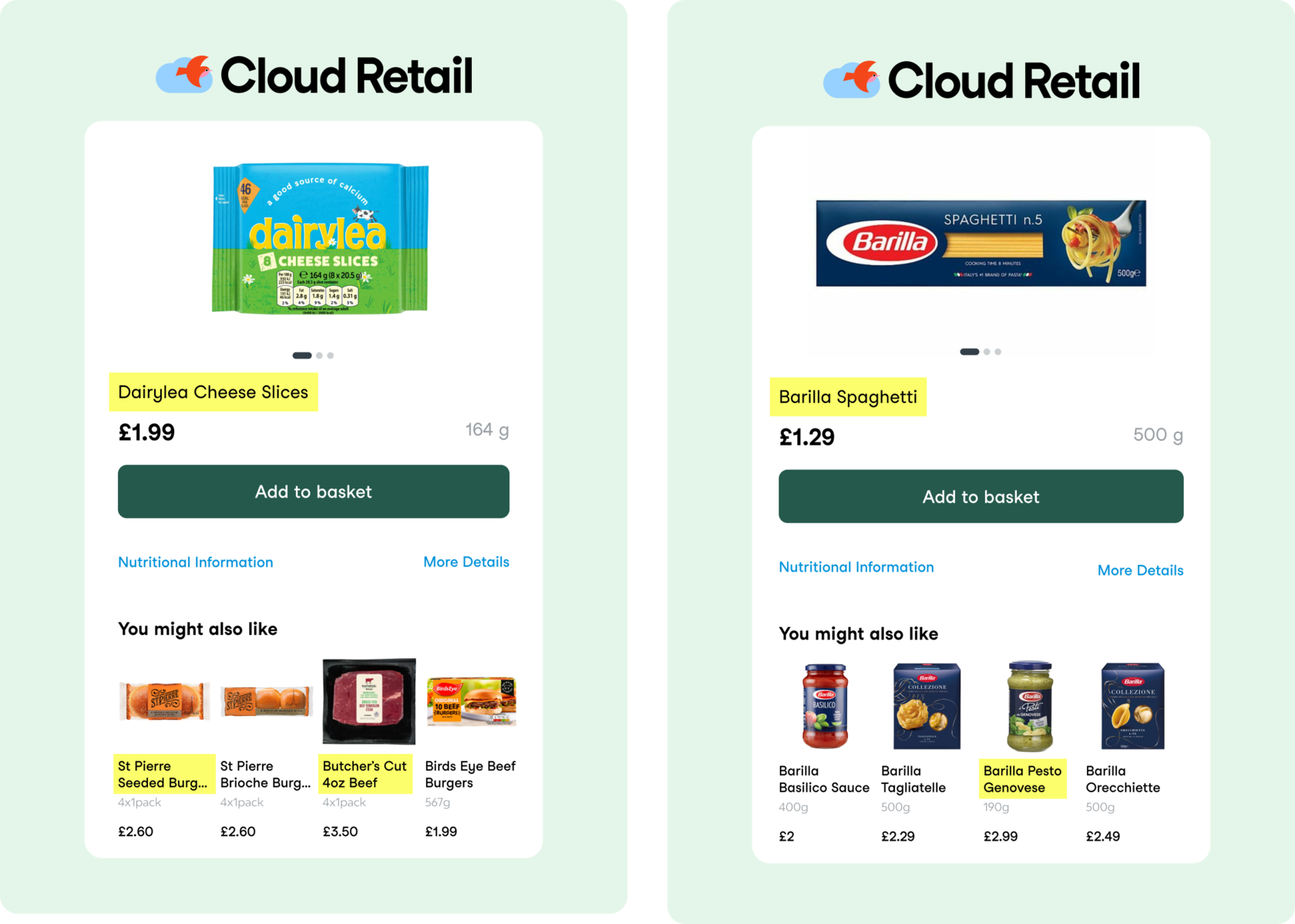

After applying some other methods, we decided to implement a product recommendation system. Our team used sales data on the item level to build an algorithm that analyses which products complement each other in customer orders. Each night, the new version of the algorithm was calculated using the latest data for the previous day. Then the results were delivered to the app to show the recommendations for complementary products on the product page and in the basket.

As a result of our efforts, we were able to raise the items per order by 35%, which had a very significant impact on the increase in our profit margins.

Summary:

With a 15-minute grocery delivery business being a highly competitive market, Jiffy had to totally focus on revenue growth and implement the above-mentioned steps, which helped us achieve great improvement and showcase the following numbers that speak for themselves:

- Stunning 6–8 seconds per item picked.

- Thanks to data-driven shelf placement and optimised picking routes, picker runs saw a reduction of over 70%.

- By utilising the growth cycle approach, we achieved close to ideal profit margin, particularly a 122% increase in gross margin in just four months.

- Revenue soared, growing by a good 3.18 times between Q3 and Q4 of 2021. This was fuelled by opening new stores in strategic locations and meticulous customer acquisition cost (CAC) optimization.

- The average order value (AOV) saw a significant boost as we reduced the share of low AOV orders from 57% to 26%, introduced a nominal delivery fee, and set a reasonable free delivery threshold.

Even though the grocery delivery business is currently spiralling downward, we are genuinely thankful for the impulse it gave Jiffy to create an innovative platform which is absolutely competitive and meets the needs of other ecommerce retailers seeking to increase their retail profit margin and strive to make their work faster, easier, and more efficient.