Reading time: 7 min

It might sound cynical, but in the world of commerce, the main and only fundamental criterion for being a successful business is to make money (or have at least an intent to do so). To generate profit effectively one must possess a clear understanding of how it can be achieved, how much capital is required, and how these funds should be strategically allocated for sustainable growth. While accounting takes charge of the retrospective and day-to-day reporting, financial planning is a tool for understanding future perspectives.

We are not going to give you a full lecture-like introduction to finance, but we will try to help you with the basics of planning, so you are prepared for your future endeavours.

Here are some questions that a financial plan can help you with:

These questions allow businesses to map out their financial journey, providing a structured framework for expenditure, investment, and profit realisation. Financial planning is essential in projects as well. Launching a project without a well-thought-out financial plan can lead to failure and loss of time and money. However, with a clear plan, potential challenges can be identified and solved in advance.

We are not going to give you a full lecture-like introduction to finance, but we will try to help you with the basics of planning, so you are prepared for your future endeavours.

Here are some questions that a financial plan can help you with:

- Will my business be profitable?

- When will I start making a profit?

- How much capital do I need to initiate and sustain my business?

- How should I allocate these financial resources?

- Am I spending my resources efficiently?

- How can I optimise my expenditures?

These questions allow businesses to map out their financial journey, providing a structured framework for expenditure, investment, and profit realisation. Financial planning is essential in projects as well. Launching a project without a well-thought-out financial plan can lead to failure and loss of time and money. However, with a clear plan, potential challenges can be identified and solved in advance.

An overview of financial planning

There are many standards on how to build financial planning. In this article, we’ll show a basic version of business economics maths.

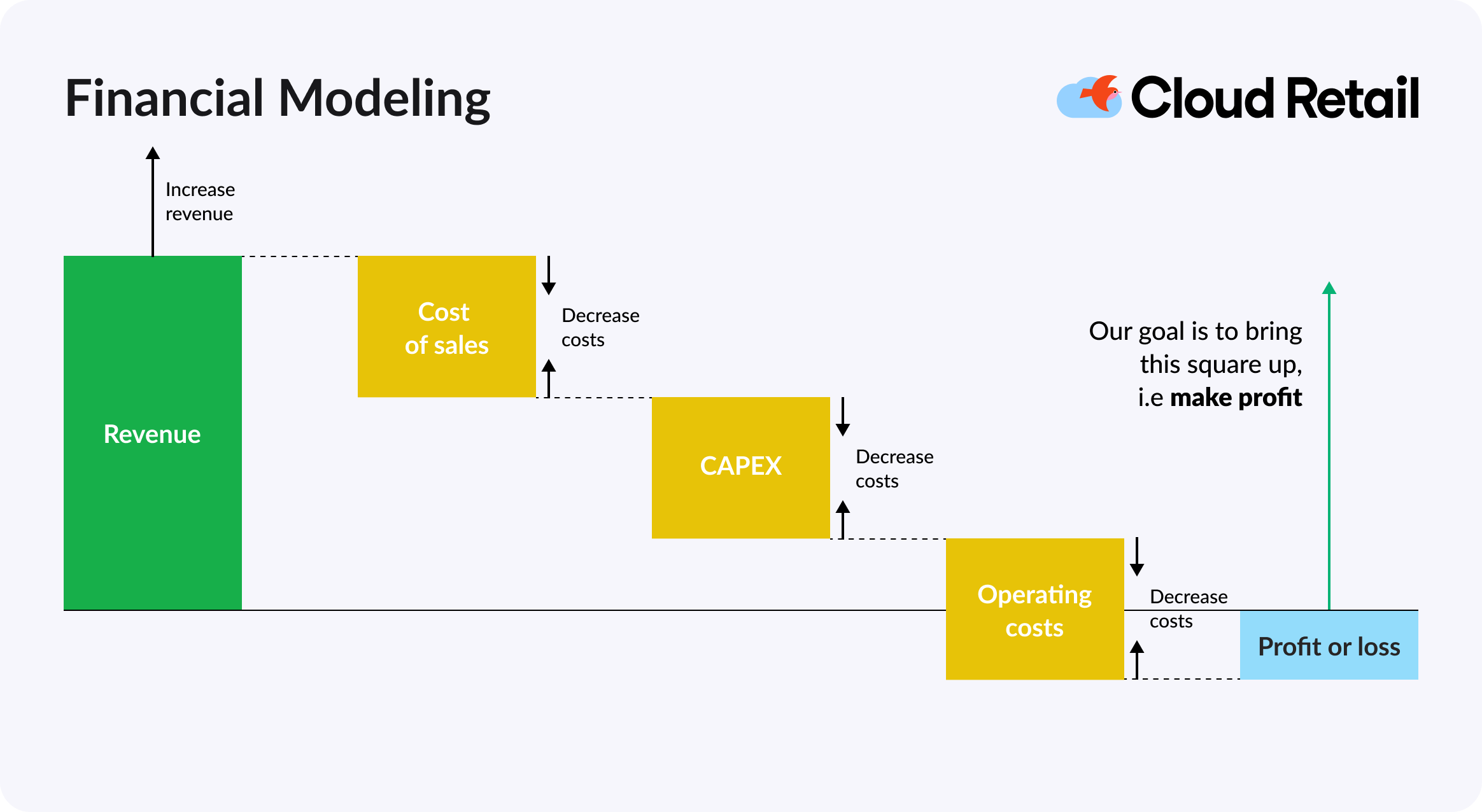

Pic. 1 Financial planning structure

Pic. 1 Financial planning structure

- Revenue Streams: This refers to all the income generated from a particular product or service, including licensing fees, sales revenue, and partner royalties. It encompasses the money earned through business activities.

- Cost of Sales: The overall cost of all activities that take place to generate a sale.

- Capital Expenses (CAPEX): These are expenses related to the creation of a service/ product. CAPEX includes all expenditures that retain their usefulness even after the investment is completed.

- Operational Expenses (OPEX): Operational expenses are recurring costs necessary to keep a business running smoothly. Examples include marketing expenses, sales costs, and IT support expenditures.

- Amount of net profits or losses: it represents a company's earnings before accounting for interest, taxes, depreciation (the decrease in the value of physical assets), and amortisation (the allocation of costs over time).

How to calculate my revenues?

1. Revenue streams

Essentially, this step involves putting down your monetisation model that outlines how your clients will contribute financially to your venture. At this stage your task is to sum all of your incomes.

Begin by assessing the nature of your revenue streams. If your business revolves around selling products, take the product prices as a starting point. Consider the daily audience you expect to reach and make an attempt to forecast the number of daily orders you anticipate receiving.

Essentially, this step involves putting down your monetisation model that outlines how your clients will contribute financially to your venture. At this stage your task is to sum all of your incomes.

Begin by assessing the nature of your revenue streams. If your business revolves around selling products, take the product prices as a starting point. Consider the daily audience you expect to reach and make an attempt to forecast the number of daily orders you anticipate receiving.

So if I sell coffee for £6 each, and I have 100 daily orders, that brings me a revenue of £600 a day.

On the other hand, if your revenue comes from licensing, determine the cost of the licence and multiply it by the expected volume of subscriptions

If I do SaaS for $30 per seat per month, and I have 5 companies joined with 3 operators each, then I have $30 x 5 x 3 = $450 of monthly revenue. Very simple math

If your company gets profit as a commission out of sales (e.g. marketplace), then this will get your GMV (Gross Merchandise Value). GMV represents the total sold goods through your platform. In this case, the percentage sellers pay you or the fee you charge for specific services is your revenue.

If you are a straightforward retailer, GMV is the final figure, signifying the cumulative cost of all goods and services sold.

2. Cost of Sales

Cost of sales (COS) represents the direct costs related to the manufacturing of goods/services that are sold to customers. It includes:

3. CAPEX

CAPEX encompasses the expenses incurred in producing the core product or service. These expenses represent various aspects, including:

a) Purchased inventory or machinery that helps in your business

b) Purchased (one-off cost), or created software

c) Human Capital involved in creating capital: Calculate the number of individuals involved in product creation, their respective salaries, and the overall cost associated with creating the product

If you are a straightforward retailer, GMV is the final figure, signifying the cumulative cost of all goods and services sold.

2. Cost of Sales

Cost of sales (COS) represents the direct costs related to the manufacturing of goods/services that are sold to customers. It includes:

- The cost of the purchase

- Raw materials or supplies needed for production

- Cost of product packaging

- Cost of storing products/materials

- Wages for employees responsible for the manufacture, collection and delivery of goods and services

- Lost goods

3. CAPEX

CAPEX encompasses the expenses incurred in producing the core product or service. These expenses represent various aspects, including:

a) Purchased inventory or machinery that helps in your business

b) Purchased (one-off cost), or created software

c) Human Capital involved in creating capital: Calculate the number of individuals involved in product creation, their respective salaries, and the overall cost associated with creating the product

For example, if you are building an AI engine, then the engine itself is your capital. To evaluate expenditures incurred in it you need to sum all of the costs of human labour put into building your platform.

If your team consists of 1 PM, 3 devs, 1 QA and a support specialist, and they have spent 1000 hours building your platform (for simplicity let’s consider they spent equally 200 hours each), then your CAPEX is:

PM salary x 200h + 3 devs salary x 200h + QA salary x 200h = IT CAPEX

Keep in mind that support is not a capital expenditure as their job is recurring and not end up in creating final value after you suspend funding in it.

It is very easy to remember that CAPEX is simply a value that doesn’t disappear after you stop investing in it: like a car, if you stop putting money into a car it doesn’t stop being valuable in contrast to OPEX.

4. OPEX

A company's OPEX includes the costs of maintaining and supporting its products and services. It covers employee salaries involved in servicing the products, marketing, and office administration. It also encompasses resources allocated for customer support, server maintenance, logistics, and delivery.

For example, the above-mentioned support is a recurring job that is valuable if put in place all the time.

The same can be said about the logistics of an internet store – you cannot just stop logistics and be happy about it. To maintain your service, this cost must be paid every month.

The same is true with oil costs, server hosting expenses, warehouse workers, and spending on printer paper, Internet, etc.

5. Profits or losses

Once you've accounted for all operational expenses, it's crucial to further deduct taxes, depreciation costs, office salaries (for non-production staff), and any incidental expenses.

Lastly, when you subtract operations and capital expenditures, profit and loss from revenue you will get your EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortisation). EBITDA is the final profit margin per production unit.

By methodically calculating your revenues and expenses, you gain valuable insights into the financial health of your business. This enables you to make informed decisions and optimise your profitability.

It is very easy to remember that CAPEX is simply a value that doesn’t disappear after you stop investing in it: like a car, if you stop putting money into a car it doesn’t stop being valuable in contrast to OPEX.

4. OPEX

A company's OPEX includes the costs of maintaining and supporting its products and services. It covers employee salaries involved in servicing the products, marketing, and office administration. It also encompasses resources allocated for customer support, server maintenance, logistics, and delivery.

For example, the above-mentioned support is a recurring job that is valuable if put in place all the time.

The same can be said about the logistics of an internet store – you cannot just stop logistics and be happy about it. To maintain your service, this cost must be paid every month.

The same is true with oil costs, server hosting expenses, warehouse workers, and spending on printer paper, Internet, etc.

5. Profits or losses

Once you've accounted for all operational expenses, it's crucial to further deduct taxes, depreciation costs, office salaries (for non-production staff), and any incidental expenses.

Lastly, when you subtract operations and capital expenditures, profit and loss from revenue you will get your EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortisation). EBITDA is the final profit margin per production unit.

By methodically calculating your revenues and expenses, you gain valuable insights into the financial health of your business. This enables you to make informed decisions and optimise your profitability.

Financial plan template

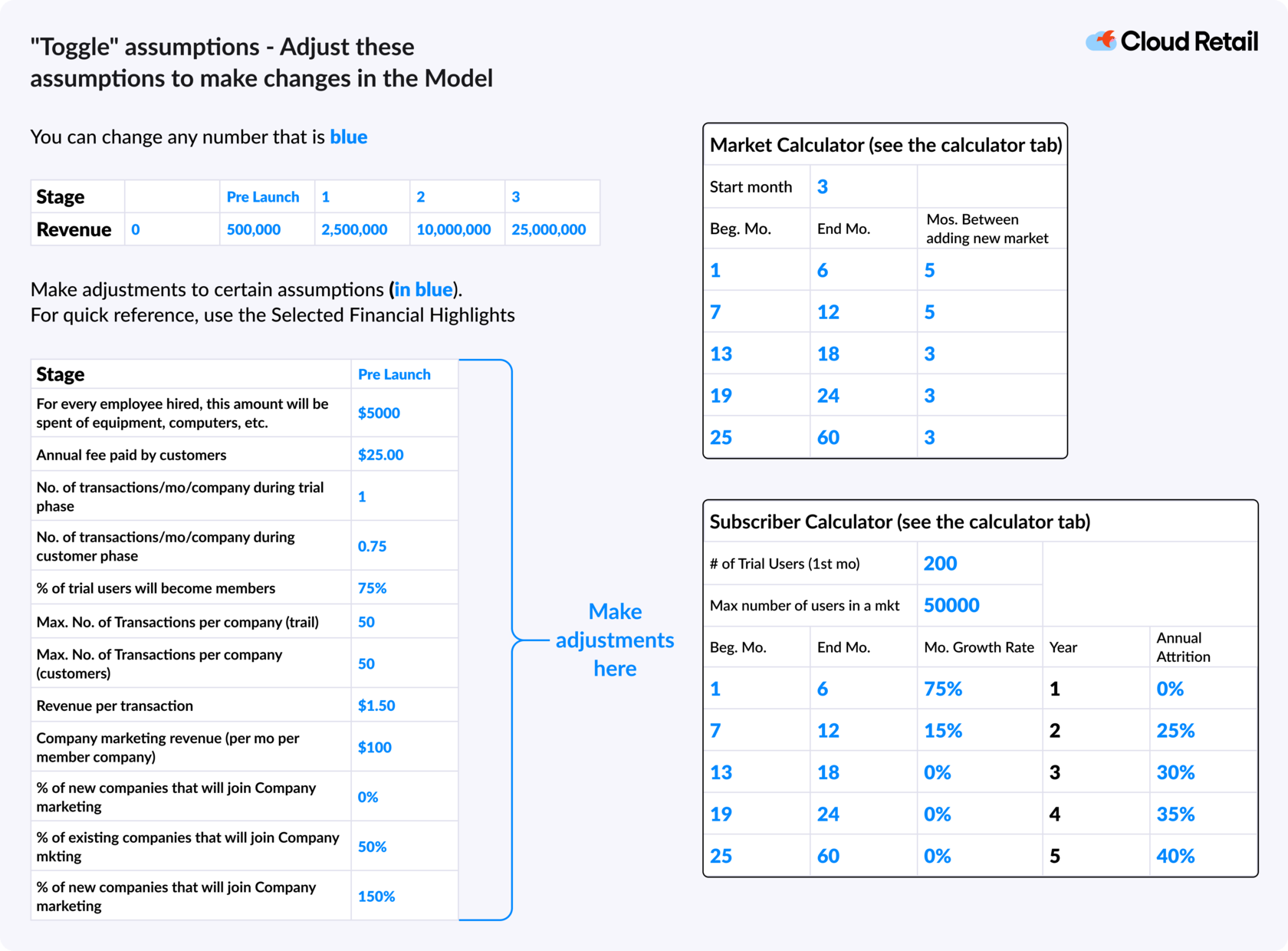

The financial plan can be calculated using a variety of table templates. We have prepared a very convenient option for calculating all of the parameters listed above. The table was created by M&A Expert Bill Snow, and we were inspired by his work and decided to share it with you.

The next financial plan template includes several sections. You will find a general table with key highlights to calculate, such as revenue, expenses, EBITDA, etc. The file also contains a table of assumptions that you can customise for your business needs. This is the most detailed financial plan template that includes all the necessary calculation formulas.

The picture below shows a small part of the material we offer you. The tables are accompanied by comments for clarity:

The next financial plan template includes several sections. You will find a general table with key highlights to calculate, such as revenue, expenses, EBITDA, etc. The file also contains a table of assumptions that you can customise for your business needs. This is the most detailed financial plan template that includes all the necessary calculation formulas.

The picture below shows a small part of the material we offer you. The tables are accompanied by comments for clarity:

Conclusion

Financial planning is essential in today's business landscape. Effective planning enables you to navigate financial complexities, forecast future scenarios, and make strategic decisions. It's not just about maintaining a business but empowering it to thrive in a competitive market. In summary, a well-crafted financial plan is the cornerstone of business success, guiding owners through their financial journey with clarity and confidence.